Blog

Oregon & Washington Tax Comparison

Oregon & Washington Tax Comparison In search of an overall comparison of state and local taxes between Oregon and Washington?...

Washington’s Supreme Court Upholds the New Capital Gains Tax

Update 11/12/2024: Washington voters have voted down Initiative 2109, which sought to repeal the capital gains tax. This means that...

Expense Classification Tips for Breweries and Distilleries: Understanding COGS, SGA, and Expenses Offsetting Revenue

Revenue growth and gross margin percentages are key metrics to owners, managers, suppliers, customers, and investors of companies in the...

Multnomah County Ballot Measure 26-238: Eviction Representation for All

Perkins was recently engaged to provide tax analysis on the proposed Multnomah County ballot measure 26-238 set to be voted...

Washington’s New Capital Gains Tax Is Being Enforced

The 2021 Washington State Legislature enacted a new 7% excise tax on long-term capital gains, effective for sales or exchanges...

Perkins & Co Wins ClearlyRated’s 2023 Best of Accounting 10-Year Diamond Award

Portland, Ore. – February 9, 2023 – Perkins & Co, the largest locally owned accounting firm in Portland, announced today...

New Grant Program Announced for Small Businesses in Oregon

Many small businesses are still feeling the impact of COVID-19. We all had high hopes for significant financial rebounds in...

Tiffany Mellow Receives AICPA 2022 Standing Ovation Honor

Portland, Ore. – December 22, 2022 – Perkins & Co, the largest locally owned accounting firm in Oregon, is thrilled...

Beyond Income Tax Returns 2022 Edition

As we head into 2022’s filing season, we want to ensure you know about information reporting requirements that you may...

Tax Treatment of Research & Experimentation Expenses, Software Development Costs in 2022 and Beyond

Tax treatment of research and experimentation (R&E) expenses and software development costs remain significantly changed for 2022 and beyond… for...

2022 Year-End Tax Planning Guide

Year-End Tax Planning for Individuals With rising interest rates, inflation, and continuing market volatility, tax planning is as essential as...

New Portland Tax Alignment Passed for City, County, and Metro

A long overdue simplification for our clients doing business in the Portland area is in the works. Recently, the Portland...

Paid Leave Oregon: Important Dates Approaching

What is Paid Leave Oregon? Effective January 1, 2023, Oregon is set to join 12 other states, plus the District...

Real Estate Tax Incentives in the Inflation Reduction Act

The recent enactment of the Inflation Reduction Act may not have had some of the larger tax changes proposed in...

Key Tax Benefits in the Inflation Reduction Act

President Biden signed the Inflation Reduction Act, a reduced version of the administration’s Build Back Better Act, into law at...

Perkins & Co Expands Specialties by Welcoming New Directors to Firm

Portland, Ore. – June 30, 2022 – Perkins & Co, the largest locally owned accounting firm in Oregon, is proud...

What to Know About the SALT Cap Workaround

Contributing authors: Nick Prelog, Nick Murray, Victoria King, Mathew Prentice, Kerry Morton, Blake Seabaugh, and Sean Wallace Many states provide...

Portland (OR) & Vancouver (WA) Tax Comparison

There has been increasing interest from many of our clients and other contacts in understanding the differences in state and...

Perkins & Co Named a Most Diverse Accounting Firm by Portland Business Journal

Portland, Ore. – March 10, 2022 – Perkins & Co, the largest locally owned accounting firm in Oregon, is proud...

Perkins & Co Wins ClearlyRated’s 2022 Best of Accounting Award for Service Excellence

Clients of winning firms are 60% more likely to be completely satisfied. PORTLAND, ORE – February 28, 2022 – Perkins...

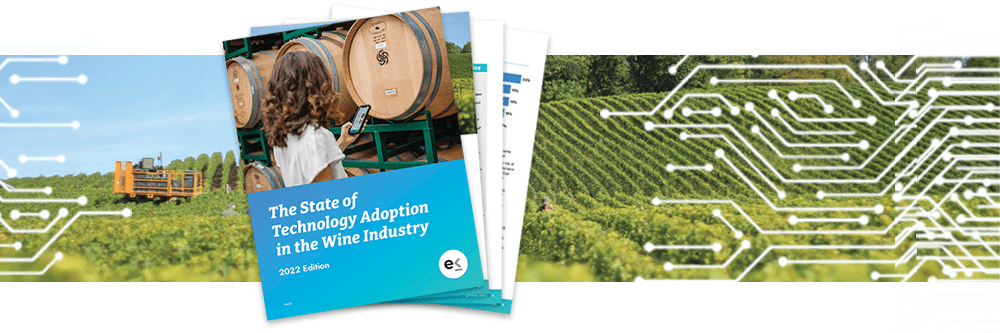

The State of Technology Adoption in the Wine Industry

It takes a lot for a wine to go from grape to glass these days, and wineries have been searching...

How FIRPTA Rules are Impacting Investments in U.S. Real Property

The Foreign Investment in Real Property Tax Act (FIRPTA) was enacted in 1980 to provide an exception to the capital...

Inbound Investing in U.S. Real Estate by Non-U.S. Persons

The world is a big place, but U.S. real estate has been a compelling investment for non-U.S. persons for a...

Building Future Value with the Long-Term in Mind |

The Third Turn Podcast

Navigating a Successful Business Transition Check out The Third Turn’s recent podcast, featuring Perkins’ Don Bielen, for an insightful conversation...