In 2016, the Financial Accounting Standards Board (FASB) issued new accounting guidance to estimate credit losses on financial assets. Privately held entities with calendar year ends are required to implement the new standard effective January 1, 2023. While banks and other traditional financial institutions will be most affected by the FASB’s new credit impairment model for financial assets based on current expected credit loss (CECL), all entities with balances due (e.g., trade receivables) or that have an off-balance-sheet credit exposure (e.g., financial guarantees) will be impacted. These include companies in the consumer and retail industry, manufacturing entities, and other non-financial institutions. A cumulative effect adjustment shall be recorded to retained earnings as of the beginning of the year of adoption to reflect the impact on the estimate for expected credit losses as of the adoption date versus the legacy accounting treatment for credit losses.

What is CECL? Let’s Take a Closer Look.

CECL refers to the credit impairment model provided in Accounting Standards Update (ASU) 2016-13, Financial Instruments — Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, as subsequently amended.

The ASU requires credit losses on most financial assets carried at amortized cost and certain other instruments to be measured using an expected credit loss model (referred to as the CECL model). Under this model, entities will estimate credit losses over the entire “contractual term” of the instrument (i.e., considering estimated prepayments) from the date of initial recognition of that instrument. The objective of CECL is to provide financial statement users with an estimate of the net amount the entity expects to collect on those assets.

How to Calculate Credit Losses Using the CECL Model

When measuring credit losses under CECL, financial assets that share similar risk characteristics (e.g., risk rating, effective interest rate, type, size, term, geographical location, vintage, etc.) should be evaluated on a collective (pool) basis, while financial assets that do not have similar risk characteristics must be evaluated individually. The ASU provides an indicative list of risk characteristics, which includes both credit and non-credit-related characteristics.

For periods beyond which the entity can make or obtain reasonable and supportable forecasts of expected credit losses, an entity should revert to historical loss information that is reflective of the contractual term of the financial asset. An entity may revert to historical loss information immediately, on a straight-line basis, or using another rational and systematic basis, depending on its facts and circumstances. The reversion method is not a policy election; an entity should support the reversion methodology and period it uses to develop its estimates of expected credit losses. The expected credit loss is recorded as an allowance for credit losses, adjusted for management’s current estimate as updated at each reporting date.

GAAP vs. CECL: What’s the Difference?

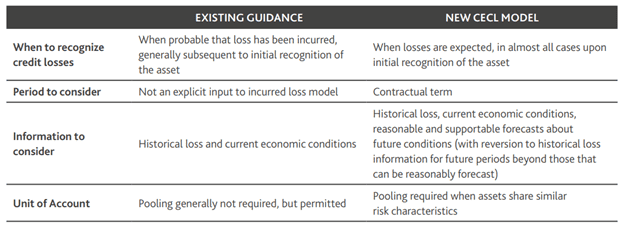

Current U.S. GAAP is based on an incurred loss model that delays recognition of credit losses until it is probable the loss has been incurred. CECL removes the threshold of “probable” and requires recognition of credit losses when such losses are “expected.” That is, even though a credit loss event may not have occurred yet, lifetime losses would still be recorded on day one (i.e., origination or purchase of the asset) under CECL based on expected future losses. A reserve is generally required even if the risk of loss is remote. Further, current practice for estimating credit losses is generally focused on the past i.e., historical loss experience and current conditions, whereas CECL also requires consideration of reasonable and supportable forecasts and, if necessary, reversion to historical loss information, as mentioned earlier. In other words, CECL is based on the entire expected life of the asset. Accordingly, it is anticipated that credit losses will be both recognized earlier and for a different amount under the new CECL model than under the prior incurred loss model.

Key changes from existing guidance to the new CECL model are summarized below:

If an asset’s risk characteristics change such that it no longer shares similar risk characteristics with other assets in the existing pool and there is no other pool having similar characteristics, that asset should be evaluated individually.

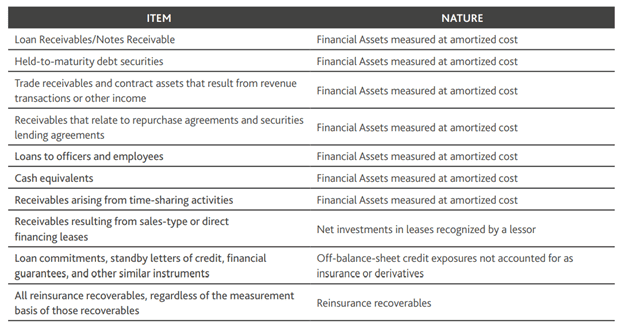

Which Financial Assets or Instruments Does CECL Apply To?

The scope of CECL is broad and includes the following:

The CECL model does not apply to financial assets measured at fair value through net income, available-for-sale debt securities, loans made to participants by defined contribution employee benefit plans, policy loan receivables of an insurance entity, or promises to give (pledges receivable) of a not-for-profit entity.

The FASB observed that some related party loans may be viewed as a capital contribution rather than a loan to be repaid. Accordingly, it was decided to scope out loans and receivables between entities under common control from the CECL model; however, other related party loans are within its scope.

CECL requires measurement of the expected credit loss even if that risk of loss is remote, regardless of the method applied to estimate credit losses. That is, life-of-asset losses must be considered. However, if a pool of assets has never historically incurred losses and current conditions and supportable forecasts show zero risk of nonpayment, then no allowance is required. However, this is an extremely narrow scope exception for measuring credit losses for a financial asset where even if a technical default occurs, the expectation of nonpayment is zero.

An example in the ASU regarding estimating the CECL reserve for trade receivables indicates that the application of CECL to short-term receivables is not expected to differ significantly from current practice. However, it is key that entities consider forward-looking information and expectation of losses in developing and documenting the allowance at inception and each reporting period instead of basing the allowance only on incurred losses. Further, entities need to determine if an allowance should be recognized even for current receivables that are not yet past due.

In general, the process for estimating life-of-trade receivables credit losses using an aging schedule can be summarized as follows:

- Pool receivables with similar risk characteristics.

- Consider whether historical loss rates need to be adjusted for asset-specific characteristics (e.g., differences in the portfolio mix).

- Adjust historical loss rates for current conditions and reasonable and supportable forecasts. If required (e.g., for longer duration receivables), revert to historical loss rates for future periods beyond those that can be reasonably forecast.

- Apply revised loss rates to the amortized cost (i.e., trade receivable balance) to determine the CECL allowance.

CECL Implementation: Where to Start

The first step we recommend performing as part of the adoption of CECL is to determine which financial assets, net investment in leases, or other exposures are in scope. Management should obtain and evaluate historical activity and perform a baseline analysis of current activity, including determining tentative asset pools and grouping customers into those pools.

From here, develop models for forecasting expected credit losses while considering any economic conditions that may impact or cause credit losses.

Throughout the process, maintain support and documentation for qualitative factors used in CECL calculations. Examine policies and procedures to ensure they are up-to-date and aligned with your CECL process. Review CECL policies and procedures at least annually and update as needed.

To ease the application of the CECL model, the FASB staff issued a series of Q&As, available on the designated Credit Losses page on the FASB website, addressing questions related to using historical loss information, making reasonable and supportable forecasts and reversion to historical loss information. See the FASB Q&A Publication for details.

If you have a question that’s not answered here or need hands-on guidance in navigating the CECL model, reach out to Perkins today. Our team of accounting professionals is well-versed in the new accounting standard.