UPDATE: As of July 24, 2024, Oregon Initiative Petition 17 has qualified for Oregon’s November 2024 General Election Ballot. This measure is officially titled Oregon Measure 118, Corporate Tax Revenue Rebate for Residents Initiative (2024). The Oregon Legislative Revenue Office has released its report on the anticipated impact of this initiative.

From Petition to Ballot Measure

The organizers of Oregon Initiative Petition 17 (IP-17), also known as the Oregon Rebate 2024, have gathered enough signatures to place the measure on the November ballot. If the Oregon Secretary of State certifies the signatures, voters will decide whether to impose an additional minimum tax on corporations this fall. The revenue generated is intended to fund annual rebate checks of up to $750 for eligible Oregon residents.

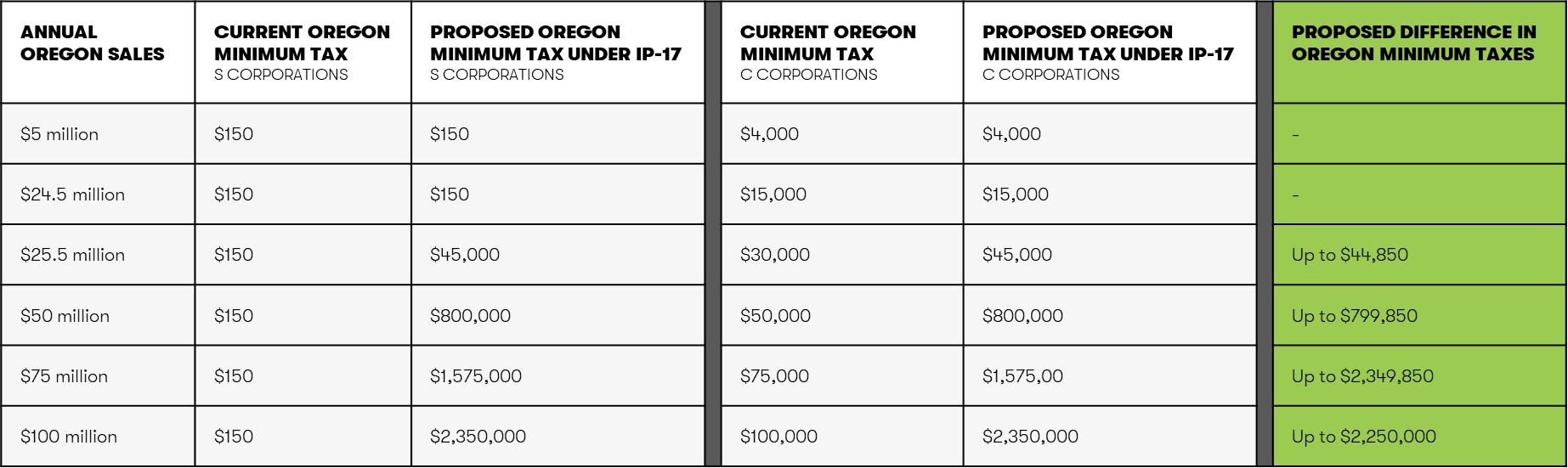

Under current law, each C corporation or affiliated group of corporations is subject to a minimum tax ranging from $150 to $100,000 based on Oregon sales. An S corporation is only subject to the minimum tax of $150, provided it does not have taxable income from built-in gains or excess net passive income.

The Oregon Rebate 2024: Proposed Tax Changes

IP-17 proposes an additional 3% tax on all corporations, including S corporations, with Oregon sales of $25 million or more, effective for tax years beginning on or after January 1, 2025. Additionally, the minimum tax for S corporations with Oregon sales of $25 million or more will now be subject to the same minimum taxes as C corporations. Both the minimum tax and the proposed additional 3% tax are not apportionable and may not be reduced by any credits. The table below illustrates how IP-17 may impact Oregon taxpayers:

IP-17 uses current definitions for determining Oregon receipts. As such, it is crucial for all businesses, especially corporations, to evaluate whether they are sourcing sales appropriately for state income tax purposes to avoid additional tax. S Corporations may also consider tax restructuring options, as IP-17 does not apply to entities taxed as a partnership. However, given the timing of the vote this fall and the effective date of IP-17, it will be critical to plan for its impacts before Election Day.

At Perkins, we are committed to staying abreast of the evolving tax landscape to assist you in making informed decisions for your business, whether it be the right tax structure or properly sourcing your sales. For further information or assistance in managing these transitions, please contact our state and local tax (SALT) Director, Sonjia Barker, or your Perkins advisor.

Download the Oregon Legislative Revenue Office's IP 17 Report