Whether you love the beach, mountains or desert, Oregon offers plenty of scenery for us to enjoy. Places to hike, ski, bike, fish, rock-climb, kayak, or just read a good book in a beautiful place. It’s your vacation and the options are endless! In honor of the vacation season and its pleasures and temptations – it’s likely you’ve seen “For Sale” signs and felt a momentary urge to buy – this post will cover the questions we are most often asked about the tax consequences of owning vacation property.

Question #1: If I buy a vacation home, what expenses can I deduct?

If the vacation property is your second residence, you will most likely be able to deduct its property taxes and mortgage interest, just like you can on your primary residence.

- Property taxes on any real property that you own as a residence or for investment purposes can be deducted as an itemized deduction.

- Interest paid on mortgages acquired to purchase or improve your primary residence plus one additional residence can be taken as an itemized deduction. The limit is two residences per tax filing unit! If you have mortgages on three residences, you have to decide which two you will deduct.

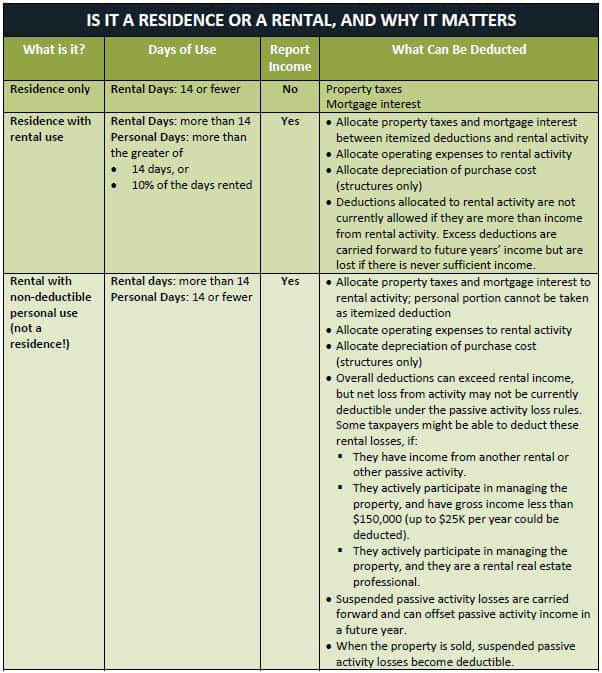

But, first, you need to determine whether the vacation home is your residence, or a rental. The IRS provides very specific guidelines for determining whether a vacation home is considered your residence for tax purposes. (See table below, Is It a Residence or a Rental?)

The key is how the property is used, with 14 days as the significant break- point. Use the property yourself for more than 14 days, and you have made it a residence. The good news? All of your property taxes and mortgage interest will be deductible one place or another. The bad? If you have other operating expenses, you can only deduct them to the extent of income from renting out the property. If you use the property yourself for less than 15 days, then it isn’t a residence at all, and other rules will apply. In this case, you would still have to allocate some expenses to the days you used the property personally, but the expenses allocated to those personal days just won’t be deductible at all.

Question #2: Do I have to report income if I rent out my vacation home?

There is a nice giveaway here if you can make it work for you –if the property is rented out to third parties for fewer than 15 days during the year, then you do not have to report the income at all, no matter how much you receive for renting it out for those days. If you rent the property for 15 days or more, you do have to report the income – but you can allocate expenses against it. See table below, Is It a Residence or Rental, for more information.

Question #3: What happens if my relatives use my vacation home?

Use by relatives, even if they pay the going rate, is considered use by you. So if you are trying to keep your personal days under 15 so that the property qualifies as a rental and won’t be considered a residence, then be very careful allowing relatives to use or even rent your vacation home.

Question #4: What else counts as personal use?

These do: Perhaps it’s obvious that allowing friends to use your rental for free is considered personal use… but so does renting your vacation home to them for less than your standard market rate. And, arranging a vacation home swap with another person also results in personal days, for the days the other person uses your vacation home.

This doesn’t: Days you spend at your vacation home working on the home so it can be rented are not personal use days. Lawn maintenance, cleaning and repairs are qualifying activities… but you have to be primarily engaged in those activities for the full day. 15 minutes watering the lawn followed by 4 hours of hiking just doesn’t fly!

Question #5: What benefit do I receive for donating use of it for a charity auction?

This is a tough answer to accept, but the allowable charitable deduction donating use of your vacation home to a charity is $0. Even if someone paid $300 a night at a charity auction to be able to stay, you don’t get to deduct anything at all for donating the right to use your property.

Time to Get Away

There are plenty of additional nuances to the tax consequences of buying a vacation home. If you are hungry for more, consider some of these additional resources:

From the IRS – Publication 527, especially Chapter 5

From Kiplinger – Tax Planning for Owning a Second Home

From houselogic.com – Tax Deductions for Vacation Homes

From Salem real estate agent Mark Redfield – Vacation Home Deduction – A Tax Guide

With all that said, don’t neglect to leave town for a few days! It’s nice out there.

If you have questions about anything we’ve outlined, please feel free to contact us and we’d be happy to answer them!

This blog post is a summary and is not intended as tax or legal advice. You should consult with your tax advisor to obtain specific advice with respect to your fact pattern.