Blog

Use It or Lose It: 6 Steps to Taking Advantage of the Increased Estate and Gift Tax Exemption Before It Sunsets

Jul. 24, 2024

Estate and gift tax exemption thresholds could be cut in half starting on December 31, 2025, leading to substantial increases...

Demystifying Cost Segregation: Maximizing Tax Benefits in Real Estate Investment

May. 22, 2024

One of the most powerful tools in the tax toolbelt for real estate developers and investors is cost segregation. Veterans...

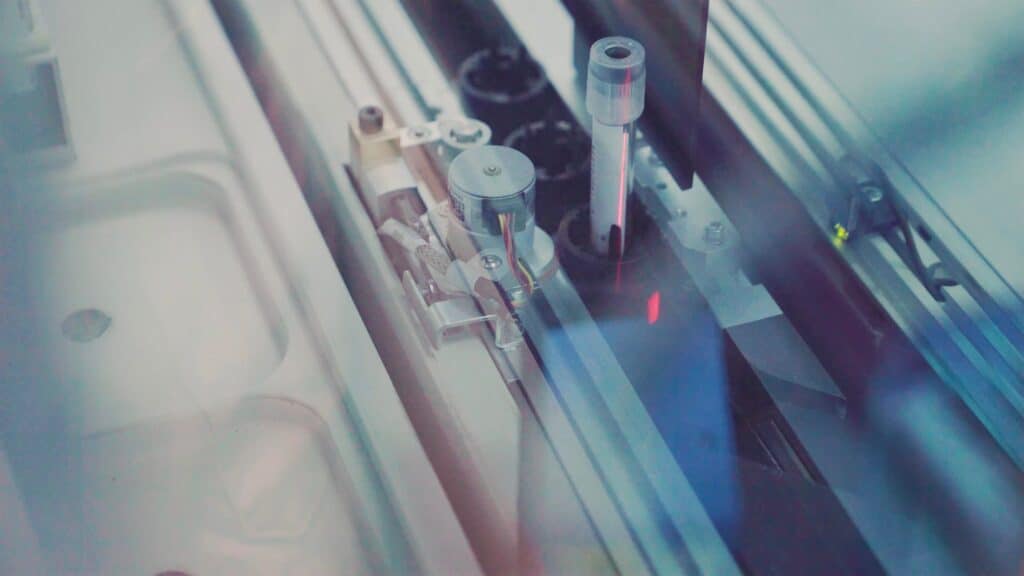

Tax Treatment of Research & Experimentation Expenses, Software Development Costs in 2022 and Beyond

Dec. 03, 2022

Tax treatment of research and experimentation (R&E) expenses and software development costs remain significantly changed for 2022 and beyond… for...

Finding the Opportunity in Opportunity Zones

Jan. 31, 2019

Since the Tax Cuts and Jobs Act (TCJA) passed in December 2017, Opportunity Zones (O-Zones) have been a commonly misunderstood...