We recently shared an overview of six steps to follow if you plan to take advantage of the increased basic exclusion amount (BEA) for the federal estate and gift tax exemption. In this article, we’ll dive deeper into what happens once the process is underway. With only 12-18 months to take action, individuals should start planning now so they can make informed decisions about protecting their estates and beneficiaries.

ICYMI: Changes are coming to estate and gift taxes in 2026

While the 2017 Tax Cuts & Jobs Act (TCJA) increased the BEA from $5 to $10 million (indexed for inflation) for decedents dying, gifts made, and generation-skipping transfers before 2026, the act includes a sunset provision reverting the estate and gift tax exemption to its pre-2018 level after December 31, 2025. Business owners and individuals with taxable estates above $7 million per individual or $14 million per married couple may face up to a 40% estate or gift tax liability if they don’t plan ahead.

Does the sunset provision affect you?

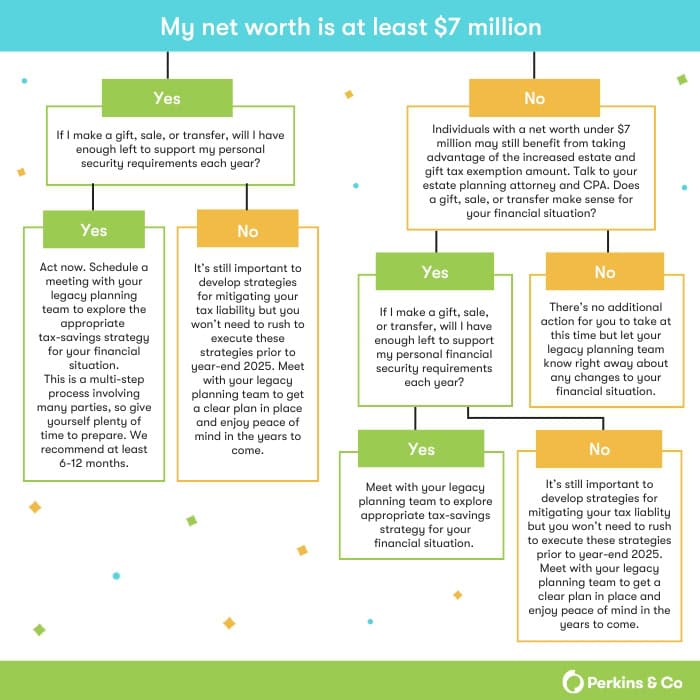

To determine if taking advantage of the increased estate and gift tax exemption amount makes sense for your financial future, use the flowchart below.

What happens once you’ve selected a tax strategy?

After you’ve partnered with your legacy planning team—which may include an estate planning attorney, your CPA, and your financial advisor—to evaluate strategies for reducing your future estate tax liability, it’s time to execute the plan that’s been selected. Your next stop: business valuation.

Clients typically approach their Perkins representative with their attorney or financial advisor. They have explored various estate tax strategies but need to determine if they can meet their personal financial requirements and if the business can cashflow the design. Perkins will then form an internal team of requisite advisors to evaluate the financial and tax ramifications of the proposed design and provide specific recommendations.

Next, it’s time to satisfy the IRS, and Perkins is here to help prepare and file gift and estate tax returns and meet full disclosure requirements.

It is essential to have assets formally valued by a qualified appraiser to satisfy requirements for gift and estate tax return purposes. A qualified appraisal must be filed with the gift or estate tax return to document the fair market value with adequate disclosure to start the 3-year statute of limitations. The valuation of a business interest may include factors such as a key person, related party transactions, and discounts for lack of marketability, control, or voting rights. A valuation can be an essential part of gift and estate planning and should also be used as part of an exit plan to build and maximize value through a third-party sale. Give yourself plenty of time for execution, as valuation can take 3-4 months to complete.

Estate planning is a team effort

If you’ve decided to make changes to your estate ahead of the 2025 sunset, expect regular meetings with each member of your legacy planning team. There are four professionals typically involved in the process. Here’s an overview of the role that each one will play:

- Financial and Transition Planning Advisor: This advisor works with you, your estate planning attorney, and your CPA to ensure that all your assets are included in your estate plan and that the personal and business requirements are satisfied. These may include bank accounts, retirement accounts, trust assets, real estate properties, and personal property.

- Estate Planning Attorney: This person helps you determine where your assets should go upon your death or incapacity. They can also provide education about the laws that affect the transfer, disbursement, and taxation of your estate and can guide you through the process to ensure your wishes are followed. Your estate planning attorney may help you with tasks such as preparing a will, identifying your beneficiaries, and establishing trusts to protect and transfer your assets.

- CPA: A CPA provides valuable insight into how to structure your strategy to minimize estate taxes. They can help you identify tax-saving strategies like gift-giving, tax-deferred sales, charitable giving, and using trusts to reduce the burden of estate taxes on your beneficiaries.

- Appraiser: An appraiser determines the value of a property or other asset for tax purposes and aids in the gifting or dividing of assets.

Regardless of your plan, regular maintenance is recommended

Tax-saving strategies are not set-it-and-forget-it activities. The plans you put in place require regular maintenance. A key to a successful strategy is to factor in your financial projections and requirements in the years ahead.

You can think of this maintenance as an annual physical or tune-up for your business or estate. As life events, tax laws, economic conditions, and asset values change, it’s essential to connect with your legacy planning team to monitor and update your plans accordingly.

Ready to meet your team?

Perkins’ integrated team of specialists includes CPAs, advisors, and appraisers for Legacy Planning, Business Transition & Succession, and Business Valuation services. Our professionals work collaboratively with attorneys and financial advisors to ensure the estate planning process goes smoothly. Reach out to us today and explore how we can help you ensure financial peace of mind throughout the best years of your life.