We held off writing our year-end message with hopes that Congress would provide clarity for taxpayers before 2014 is over. We finally got what we were looking for! The Senate passed H.B. 5771, The Tax Increase Prevention Act of 2014 (the “Act”) late on December 16th. The Act previously passed the House on December 3rd, and is expected to be signed into law by the President.

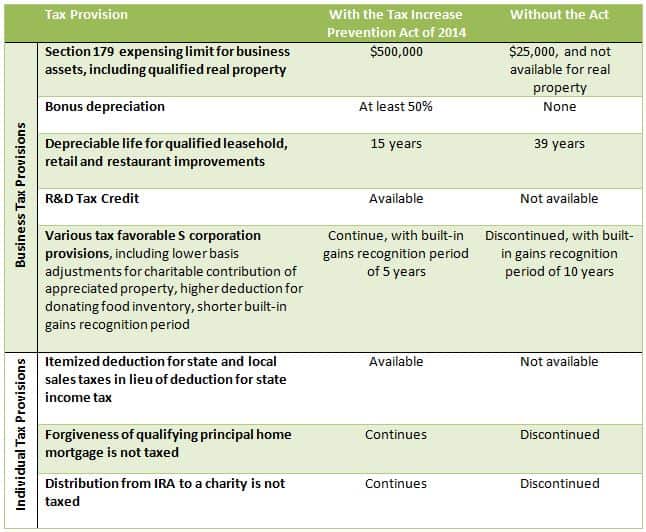

The good news: the Act extends a number of familiar tax breaks retroactively to January 1, 2014. Bonus depreciation, increased section 179 expensing, the R&D Tax Credit, the ability for individuals to deduct state and local sales taxes as an itemized deduction, and many other helpful provisions are still with us. Here are some highlights:

For a more comprehensive list, as well as a comparison to laws in place in previous years, see our more thorough table, “What’s the Law, When?”

For a more comprehensive list, as well as a comparison to laws in place in previous years, see our more thorough table, “What’s the Law, When?”

The bad news: None of these provisions were extended permanently, or even for 2015. The “Without the Act” column above also accurately describes the law in place for 2015, absent Congressional action in the new year.

What might be coming: With one party now controlling both chambers of Congress, comprehensive tax reform may have a slim window for passage in the next 12 to 15 months. Commentators seem to agree that if the new Congress can’t get a significant reform bill passed by early 2016, presidential election year mayhem will interfere, and the can will be kicked down the road yet again. The most likely starting point for comprehensive reform would be the discussion draft issued by Dave Camp (R-Michigan) in early 2014.

With major reform impossible for 2014, and highly unlikely for 2015, here are some key areas to consider for year-end 2014 and into 2015:

What we know

Health Care Reform

For 2014, most individuals are required under health care reform to have health insurance coverage, or they will be subject to a penalty, assessed on their 2014 returns. The penalty is $95, or 1% of gross income above $10,150 (single) / $20,300 (married filing jointly). For 2015, the penalty increases to $325 or 2% of gross income above the threshold. The penalty is capped at the cost of coverage through the applicable government exchange.

In 2015 (but not 2014), businesses with more than 50 full-time employees are required to offer affordable health insurance coverage to their full-time employees, or pay a penalty. Planning for compliance with these rules can be complex and will involve tracking employee hours in new ways. Even if you are providing health insurance to all employees, you will need to report new information to the IRS under the Affordable Care Act (ACA). For all employers, health care reform has eliminated some types of health reimbursement arrangements, and prohibits employers from deducting as an employee benefit the cost of reimbursing employees for an individual policy. If you are not sure if you have adequately addressed how health care reform affects your business, we recommend that you contact your benefits consultant or your Perkins & Co advisor without delay.

Tax rates

Individual and corporate tax rates are unchanged for 2014 and 2015 from the 2013 levels. This includes the net investment income tax, first imposed in 2013 on the investment income of individual taxpayers with gross income of $200,000 (single) / $250,000 (married filing jointly). Maximum individual rates remain 39.6%, with a maximum capital gains rate of 20% – and tack on another 3.8% of net investment income if you earn more than the thresholds listed above. What can you do before year-end? Consider making charitable contributions, especially donations of appreciated securities, and consider pre-paying state income taxes, particularly if you have an unusually high level of investment income in 2014 compared to your “normal” year.

The maximum corporate rate remains 35% for 2014 and probably 2015 as well. What can you do before year-end? With the (possibly temporary) return of bonus depreciation and higher section 179 limits, if you still have time to get new equipment or capital improvements in service before December 31st, this is a good year to do it.

Tangible Property Regulations Effective 1/1/2014

If you haven’t already considered the impacts of these new requirements on your business, please do it now! Most businesses should anticipate the need to file one or more changes in accounting method to adopt the new rules along with 2014 income tax returns.

What is on your mind? Our tax guide offers tips for minimizing your tax liabilities and maximizing your potential savings. But our best advice is to talk the specifics of your situation over with your Perkins & Co advisor. We may not know what’s going to happen in 2015, but we can help define the possible paths and make it easier for you to step forward into an uncertain future.

This blog post is a summary and is not intended as tax or legal advice. You should consult with your tax advisor to obtain specific advice with respect to your fact pattern.