Susan Sterne

It’s Time to Prepare for the Restaurant Revitalization Fund (RRF)

Over the past week, the SBA has started posting draft forms and guidelines for the Restaurant Revitalization Fund, which was...

The Restaurant Revitalization Fund (RRF) – Small Business Support That’s Not Just for Restaurants

Thanks to recently enacted legislation, restaurants* and bars hard hit by COVID-19 could see some financial relief in coming months....

CARES Act – Focus on Tax Provisions for Businesses & Individuals

On March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief and Economic Security Act (the CARES Act...

The Perkins Field Guide to Tax Reform

Where’s the comprehensive tax reform we’ve been hearing about for the past few years? 2010’s Simpson-Bowles plan, although it had...

TPR Update: Small Businesses Need Not File Forms 3115

Last Friday the 13th was one to remember at Perkins & Co! After months of gearing up to prepare Forms 3115...

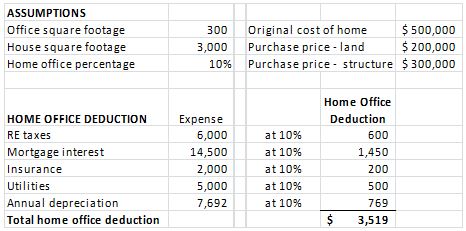

Deducting a Home Office: Simpler May Be Better

For those of us who go to a downtown office every weekday, the benefits of working from home glow brightly:...

Net Investment Income Tax for 1040 Filers: First Year Thoughts

Since the Affordable Care Act was passed in 2010, there have been plenty of articles discussing one of its new...

Vacation: It’s Time to Get Away!

Whether you love the beach, mountains or desert, Oregon offers plenty of scenery for us to enjoy. Places to hike,...

Judge Overturns Oregon’s Same-Sex Marriage Ban

Federal judge Michael McShane ruled on May 19th that Oregon’s prohibition on same-sex marriage was unconstitutional. We devoted a lot...

Keeping Your Financial and Tax Information Secure

As we reported in early April, the IRS has seen increasing numbers of fraudulently-filed individual tax returns in recent years....

Individuals: Beware of Higher Level of Identity Theft Cases

Filing one’s tax return each year can be stressful…and we’ve found an extra cause of stress this year in tax-return...

Getting Information Ready for Tax Accountants Part II: Individuals

It happens every year around this time – “important tax documents” arrive in your mailbox or inbox, and you know...

The Magic of Tax Planning!

As 2013 draws to an end, we at Perkins find ourselves with a few tax planning tricks up our sleeves...

Oregon Recognizes Out-of-State Same-Sex Marriages

Despite Oregon’s continuing constitutional ban on same-sex marriages, the Oregon Department of Administrative Services announced today that all Oregon agencies...

Oregon Budget Deal Good for Active Owners of Partnerships, LLCs, S Corps

Last week, the Oregon legislature passed HB 3601 as part of the “grand bargain” that, among other provisions, changes individual...

Married In Any Jurisdiction Means Married Under Federal Tax Law

Earlier this summer, the Supreme Court ruled unconstitutional the provisions of the federal Defense of Marriage Act that prohibited same-sex...

Perkins & Co Adds Two Shareholders

July 23, 2013 Portland, Ore. – Perkins & Co, Portland’s largest locally owned public accounting firm, is excited to announce...

Corporations: Beware “Corporate Records Service” Mailing!

Some of our clients are reporting that they have received a “2013 – Annual Records Solicitation Form” from Corporate Records...

Employer Health Insurance Mandate Delayed until 2015

The Treasury Department announced yesterday that it has decided to delay the effective date of the employer health insurance mandate...

Post-DOMA, Clarity for Oregon’s RDPs?

Yesterday was an interesting day for tax practitioners and estate planners who work with same-sex couples! As much as we...

Minimizing “Net Investment Income”

The Affordable Care Act established a new 3.8% surtax on “net investment income” that first applies in 2013. This tax...

Managing the Impact of 2012 ATRA Tax Rate Increases

The American Taxpayer Relief Act of 2012 was signed into law on January 2, 2013. While it included a lot...

Did “Sleep-Deprived Octogenarians” drop the New Year’s Ball on You?

Maybe. Maybe not. Happy New Year… from Perkins & Co and from the US Congress. The House and Senate have...

IRS Releases New Information About Medicare Tax Surcharges

Starting January 1, 2013, two new tax “surcharges” will apply to income earned by individuals making more than $200,000 per...