For those of us who go to a downtown office every weekday, the benefits of working from home glow brightly: no morning commute and working in sweatpants! My kitchen, my coffee! Walking my own dog! And, perhaps, a nice tax deduction for using a home office.

As we will discuss below, qualifying for a home office deduction takes a lot more than just working from home, but we thought the time was right for discussing home offices, and in particular, a simplified deduction method that the IRS started offering in 2013. Since this method has been allowed for the past year, this isn’t breaking news; but the simplified deduction is a terrific option – better than it looks at first glance.

The simplified method provides a maximum deduction of $1,500, for offices that are 300 square feet or more. For taxpayers who have been deducting home office expenses for many years, this might sound like a measly allowance; however, there are additional benefits to claiming the simplified method that increase its value beyond the $5/square foot permitted.

Do you have a deductible home office? Working from home is increasingly common – but not all home work areas qualify for a tax deduction. Before you read further, check your situation against these general criteria:

- 1) Your home office is your only office. [Employees who choose to work from home even though the employer supplies office space elsewhere do not qualify for a home office deduction.]

- 2) An office is necessary for your business, and

- 3) Your home office is a separate defined area, room or structure that is used exclusively for business.

[The actual requirements are more nuanced than this, but if you can answer yes to all of these questions, you have a good chance of qualifying to claim a home office deduction.]

How does the traditional version of the deduction work?

We want to show you that the simplified deduction is worth considering. Before we start making our case, here’s a brief review of the traditional home office deduction calculation:

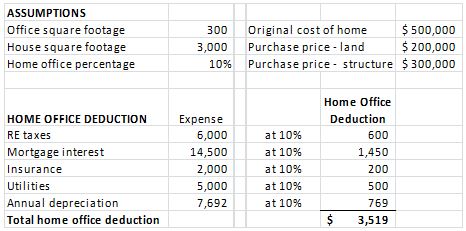

- 1) Certain expenses relating to your home are allocated to your home office based on the percentage of your home occupied by the office. If you have a 300 square foot office and 3,000 square feet of living space in your home, then 10% of the expenses would be allocated to the home deduction.

- 2) The types of items that can be allocated include mortgage interest, real property taxes, homeowner’s insurance, and utilities, as well as depreciation of the cost of your home.

- 3) Depreciation is based on what you originally paid for the home, not its current value, and only the amount of your purchase price that relates to the building, not the land. Depreciation is calculated as 1/39th of your cost of the building for each full year, and the 1/39th is then multiplied by the home office percentage (10% in our example).

Deductions under this method can be substantial, depending on the size of your home. Here’s an example:

The home office deduction is $3,519 – not too shabby! That’ll be a nice chunk out of your self-employment income, if you are self-employed, and all for expenses you would’ve incurred anyway, just from living in the home. However, there are some hidden trade-offs. Let’s take a look at the simplified method and compare.

Simpler Can Be Better

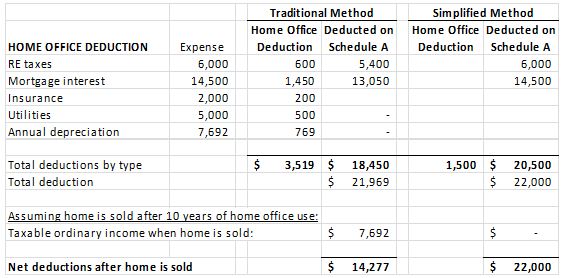

Under the simplified method, the calculation is indeed simple: it’s the square footage of the office times $5 per square foot, capped at $1,500. In this case, the deduction would be 5 x 300 = $1,500. How can that possibly be as beneficial as the traditional deduction of $3,519?

Consider this:

- 1) Mortgage interest on your primary residence and real property taxes are deductible as itemized deductions anyway. If you allocate some of these expenses to your home office deduction, you’re reducing your itemized deductions to increase your home office deduction – the net benefit may be small, or there may not be any net benefit.

- 2) While gain (up to $250,000 per person) on the sale of your primary residence is generally tax free, taking a home office deduction will usually create some taxable gain when you sell the home. To the extent that you previously deducted depreciation for a home office, you will have to pay tax at ordinary income rates on amount of depreciation you previously claimed if you sell the home at a gain.

Here’s our example, modified to show these effects as well as the deduction claimed as a home office deduction under each method:

Indeed, the home office element of the deduction is higher under the traditional method – but when you include the Schedule A deduction for mortgage interest and property taxes, the annual total deduction allowed is just about the same with the simplified method. Once we take into account the gain that would be recognized when the home is sold, the simplified method has the clear advantage.

As a final enticement, keep in mind that tracking your utilities expense is extra work. As tax preparers, we know that those home office expenses are often the last pieces of information we receive from you. Wouldn’t it be nice to be able to stop worrying about them? The simplified method makes this possible, and (in many cases), without any loss of tax benefit.

Ask Your Tax Advisor

We freely admit that the examples here were constructed to show the simplified deduction in a good light, and that there are complexities we are not addressing. For instance, if you are self-employed and using a home office, the tax rate that applies to the home office deduction is higher than the tax rate that applies to the itemized deduction of mortgage interest and property taxes. If you are subject to alternative minimum tax, the property tax itemized deduction is worth much less to you. If you never intend to sell your residence, the gain inclusion is meaningless. Just changing the many assumed numbers in the example could generate a clearer benefit to either method. So, as ever, we encourage you to ask your tax advisor to consider your specific situation. But, if you are on the borderline, or if you really don’t like keeping track of those utility expenses – we want you to feel good about choosing to use the simplified method. Like some houses, it’s better than it looks from the outside!

This blog post is a summary and is not intended as tax or legal advice. You should consult with your tax advisor to obtain specific advice with respect to your fact pattern.