Blog

Congress Passed The Tax Increase Prevention Act of 2014

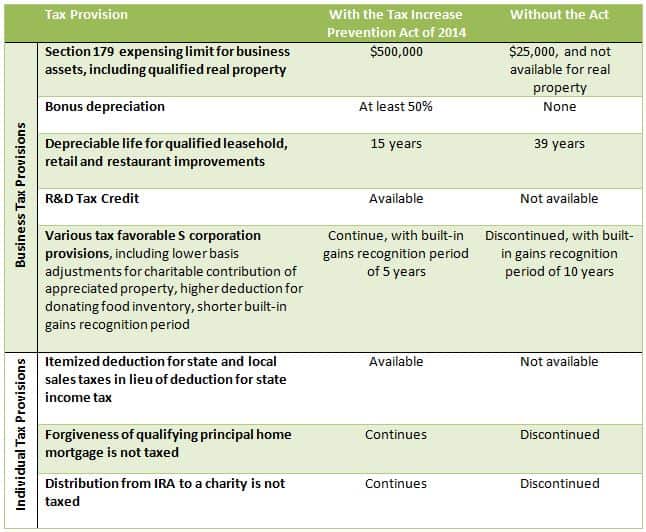

We held off writing our year-end message with hopes that Congress would provide clarity for taxpayers before 2014 is over....

AICPA Warning – Is your Employee Benefit Plan Auditor Qualified?

On December 3, 2014 the AICPA Employee Benefit Plan Audit Quality Center issued a Plan Advisory, The Importance of Hiring...

The New Tangible Property Rules Take Effect Now

As the expression goes, change is inevitable. This year, change in accounting method may also be inevitable. We’ve previously discussed...

U.S. Estate Tax for Non-US Decedents

“What on earth is an estate tax?” As there are many foreign countries that do not have estate/inheritance taxes, this...

Net Investment Income Tax for 1040 Filers: First Year Thoughts

Since the Affordable Care Act was passed in 2010, there have been plenty of articles discussing one of its new...

Are You Saving Enough for Retirement?

Day in and day out you’re bombarded with endless variations of that same question. Invariably, this question leads to the...

Perkins & Co Adds Two Shareholders

August 19, 2014 Portland, Ore. – Perkins & Co, Portland’s largest locally owned public accounting firm, is excited to announce the...

Could You be an Oregon Resident and Not Even Know It?

We recently posted about the federal tax consequences of owning a vacation home. This post explores a possible Oregon tax...

Vacation: It’s Time to Get Away!

Whether you love the beach, mountains or desert, Oregon offers plenty of scenery for us to enjoy. Places to hike,...

The Benefits of Tax Planning

Expert advice bombards the casual observer on a daily basis with ways to tax plan and achieve the greatest benefit...

What’s FATCA Got to Do with Me?

To any individual who has a foreign bank account and to any person with tax reporting responsibilities for a multinational...

Judge Overturns Oregon’s Same-Sex Marriage Ban

Federal judge Michael McShane ruled on May 19th that Oregon’s prohibition on same-sex marriage was unconstitutional. We devoted a lot...